stagflation is back on the menu

Economic Update

As anticipated, the Federal Reserve reduced interest rates by 25 basis points this month, lowering the federal funds rate to a range of 4.00% to 4.25%. The decision comes amid conflicting economic indicators and mounting pressure from the White House to ease rates further. According to the latest dot plot, Fed officials project an additional 50 basis point cut this year, which would bring the rate down to 3.50% to 3.75%. However, with inflation creeping upward and job growth decelerating, concerns about stagflation, a scenario marked by slowing economic growth and rising inflation, are beginning to surface.

State of Corporate Credit

Days Sales Outstanding (DSO) is a key performance indicator that measures the average number of days it takes a company to collect payment after a sale. According to the Hackett Group’s 2025 U.S. Working Capital Survey, both DSO and Days Inventory Outstanding (DIO) deteriorated slightly year over year. DSO in particular saw its second straight year of degradation, as customer bargaining power drove extended payment terms. As a result, accounts receivable now represents the largest portion of excess working capital. The continued rise in DSO underscores persistent challenges in managing receivables and optimizing cash flow.

Insolvencies

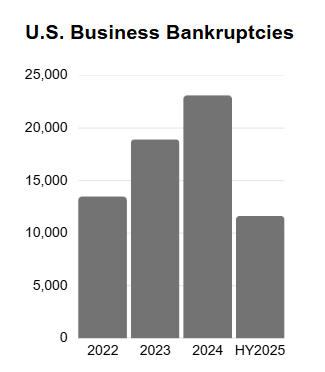

Although commercial Chapter 11 filings declined by 0.5% in August 2025 compared to the same month in 2024, the number of financially distressed small businesses opting for Subchapter V of Chapter 11 rose by 17% year over year, according to data from Epiq AACER. This uptick highlights the ongoing challenges small businesses face, including labor quality concerns, inflationary pressures, and elevated debt levels. The overall trajectory of bankruptcy filings continues to trend upward.

Current & Evolving Credit Risks

SEC Considering Shift from Quarterly to Semiannual Reporting

The Securities and Exchange Commission (SEC) is weighing a proposal, supported by President Donald Trump, to shift public companies’ financial reporting from a quarterly to a semiannual schedule. Since 1970, quarterly reporting has been the standard in the U.S., designed to promote corporate transparency. Proponents of the change argue it would ease regulatory burdens and reduce overhead costs for companies. The Long-Term Stock Exchange, which launched in 2020, plans to formally petition the SEC in the coming weeks to support the shift. However, critics contend that frequent reporting fosters financial discipline and ensures transparency for investors. From a credit risk perspective, less frequent disclosures could hinder credit managers’ ability to monitor and assess risk effectively.

Default Risk Post-Injection by Sponsors

Since 2020, sponsor cash injections into troubled PE portfolio companies have a limited success rate, with over one-third defaulting and most remaining in high-risk rating categories, according to a new report by S&P Global Ratings. Specifically, the agency reported that around 37% of companies getting sponsor cash injections between January 2020 and June 30, 2025, subsequently defaulted (either a selective or payment default). While injections may delay default, they rarely improve long-term credit fundamentals. The S&P report pointed out that, while the new capital can extend a borrower’s runway, the investments “seldom alter our assessment of a borrower’s debt-servicing capability over longer periods.” This is another item to consider when reviewing PE-backed companies.