Federal Shutdown Increases Uncertainty

Economic Update

With official government data unavailable due to the shutdown, the Federal Reserve’s October Beige Book reported that economic activity changed little on balance since the summer. Pricing pressures have intensified, while labor market conditions remain soft. The Beige Book is a Federal Reserve System publication about current economic conditions across the 12 Federal Reserve Districts. In light of these developments, the Federal Reserve is almost certain to issue a rate cut at its meeting later this month. The current federal funds rate stands at 4.00% to 4.25%.

State of Corporate Credit

While the number of M&A transactions declined modestly in the third quarter of 2025, the aggregate deal value for U.S. and Canadian transactions surged nearly 50% quarter over quarter, reaching $608.4 billion, up from $410.6 billion, according to S&P Global Market Intelligence. The increase was driven by several large deals. Despite ongoing trade tensions, private equity firms remain active, deploying record levels of dry powder. Additionally, anticipated rate cuts by the Federal Reserve may further support dealmaking momentum as we close out 2025.

Insolvencies

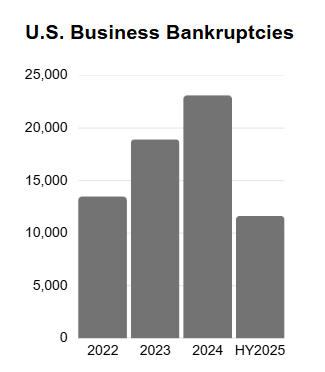

Commercial Chapter 11 filings rose 3% year over year in September 2025, according to Epiq AACER data. However, Commercial Chapter 11 filings for the first nine months of 2025 declined 3% compared to the same period in 2024. We note underlying credit fundamentals remain pressured. Businesses are starting to report weak profitability, driven by softening demand conditions, tariff impacts, and a deterioration in consumer credit quality. These factors are contributing to elevated financial stress across several sectors. Looking ahead, we expect bankruptcy filings to trend upward as macroeconomic headwinds persist.

Current & Evolving Credit Risks

U.S. Government Shutdown

The U.S. government shut down on October 1, following a legislative impasse over spending proposals. As a result, several federal agencies, including the Bureau of Labor Statistics, are closed, leading to delayed statistical releases. The absence of timely data may constrain the Federal Reserve’s ability to assess economic conditions ahead of its upcoming rate decision later this month. Oxford Economics estimates that each week of the shutdown could reduce U.S. GDP growth by approximately 0.1%, equating to a $7 billion weekly economic impact. Prolonged disruption may further weigh on business and consumer sentiment, adding downside risk to near-term growth forecasts.

Small Business Optimism Retreats in September but Remains Above Historical Average

The NFIB Small Business Optimism Index declined for the first time in three months but remains above its 52-year historical average. According to NFIB Chief Economist Bill Dunkelberg, “While most owners evaluate their own business as currently healthy, they are having to manage rising inflationary pressures, slower sales expectations, and ongoing labor market challenges.” Reflecting these challenges, the index’s uncertainty component rose to its fourth-highest level in five decades. Similarly, the Atlanta Fed’s Survey of Business Uncertainty highlights elevated concerns around future sales growth. We expect these challenges to weigh on credit quality across businesses, particularly those with high leverage or exposure to discretionary spending.

Truck Tariffs

President Trump announced a 25% tariff on imported medium- and heavy-duty trucks and associated parts, set to take effect on November 1, 2025. The tariff is designed to boost domestic production and will benefit U.S. truck makers like PACCAR. However, supply chains could come under pressure, especially if trucks and related parts do not qualify for preferential tariff treatment under the United States-Mexico-Canada Agreement (USMCA).