On balance, M&A activity has been notably muted in 2025. This slowdown is primarily due to several factors, including a decline in asset quality, dwindling corporate profits, and market uncertainty stemming from U.S. tariff and trade policy. Consequently, M&A volumes are subdued across nearly all industries, despite a record amount of dry powder available in the market.

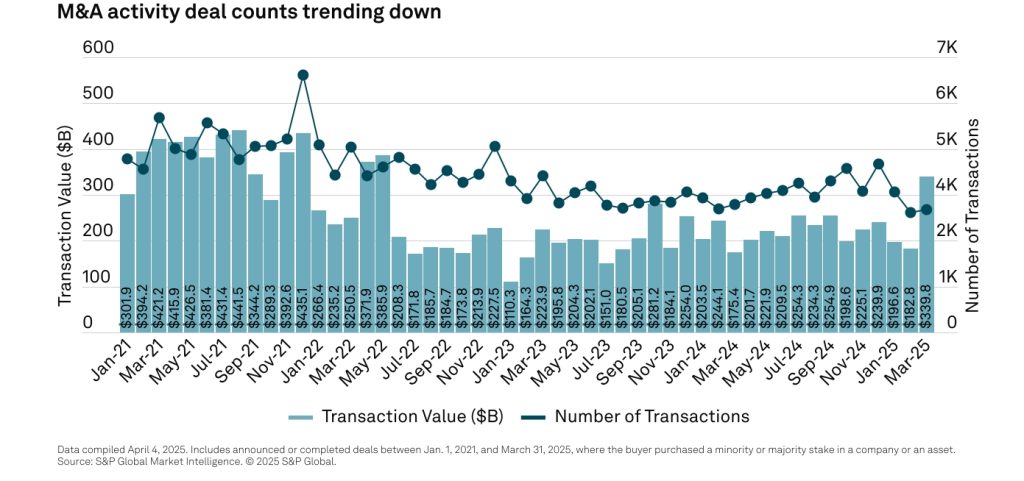

Several sources reported a decrease in the number of deals in the first quarter of 2025. As reported by KeyBanc Capital Markets, first quarter 2025 transaction volume decreased 17.7% year over year, while aggregate value increased 3.9%. Deal flow remained constrained due to uncertainties surrounding the U.S. economic environment, the longer-term interest rate outlook, and elevated inflation levels. However, several mega-deals significantly drove overall deal value higher. Large-cap deals continue to drive the market as buyers search for quality. Smaller middle-market deals continue to face significant headwinds as closure rates have eroded across the industry. S&P Global also reported that first quarter deal counts declined sharply, down 19% from the fourth quarter of 2024. February saw only 3,208 deals announced, which represented the fewest number of monthly deals announced over the past four years.

“The excitement and positive momentum observed in the M&A market at the start of the year has morphed into something more lukewarm. The uncertainty over tariffs has led to many dealmakers hitting pause on their transaction, wanting to know how these will play out before committing to a deal,” as summarized by Carole Streicher, Head of Deal Advisory & Strategy at KPMG US. BMO’s Middle Market M&A Update added that shareholders will need to determine whether their transaction goals would benefit from waiting for greater certainty in an increasingly volatile trade environment.

U.S. corporate profits in the first quarter of 2025 also saw the steepest drop since 2020 as companies feel the pressure from tariffs. The 2.9% decrease in profits followed a 5.4% advance in the fourth quarter, according to data from the Commerce Department’s Bureau of Economic Analysis (BEA). Many companies have also withdrawn or refrained from giving financial guidance for 2025, citing the uncertainty caused by the on-again and off-again nature of the tariffs.

As we approach the second half of the year, if clarity improves around U.S. tariff and trade policy, economic uncertainties ease, and the Fed cut interest rates, the broader M&A market will benefit. Investors hold near record-high dry powder, companies are building a growing backlog of pre-market deals, and corporate balance sheets remain robust.