Small businesses filing for reorganization under Chapter 11’s Subchapter V provision surged 43% in January 2024, highlighting increased utilization of this streamlined process. According to the data, filings reached 176 in January 2024, compared to 123 in the same month the previous year. However, a significant challenge looms: the debt eligibility limit for Subchapter V elections is set to revert from $7.5 million to $2.7 million in late June, potentially restricting access for many struggling businesses.

Recognizing this critical issue, the American Bankruptcy Institute’s (ABI) Subchapter V Task Force submitted a preliminary report to Congress on December 15th. Their findings, based on nine months of public hearings, roundtable discussions, and an industry survey, strongly support maintaining the current $7.5 million debt limit. This recommendation aims to ensure greater access to Subchapter V for small businesses, offering more efficient and affordable paths to financial recovery compared to the traditional Chapter 11 process.

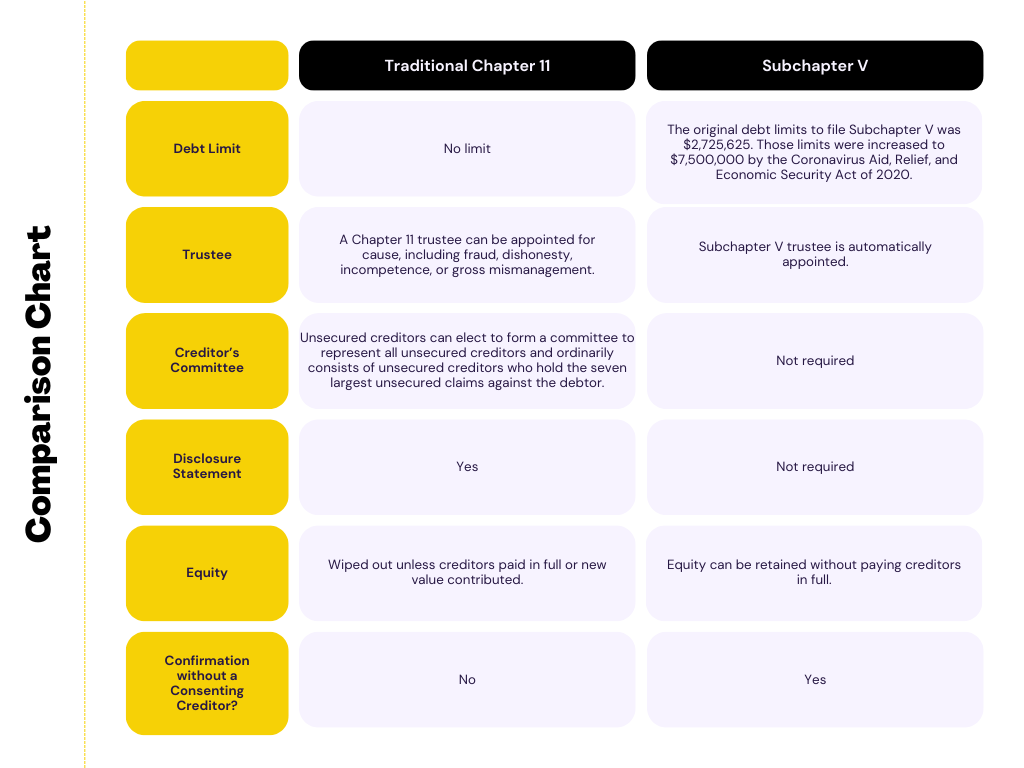

While these eligibility requirements remain through mid-2024, it’s important for credit managers to know what percent of their customer portfolio is made up of businesses that could file using Subchapter V. As explained by Jason Torf of Tucker Ellis LLP, “You might even consider placing eligible customers in a higher risk category. There is an additional layer of risk with Subchapter V that does not exist in the traditional Chapter 11 route, and debt recovery is not as successful.” A creditors’ committee is not automatically appointed in Subchapter V and is instead only appointed upon a “showing of cause.” An unsecured creditors’ committee wields a great deal of power and may be able to delay or even prevent a plan confirmation if they feel they aren’t getting the best deal. However, in Subchapter V, the goal is to decrease the costs. While a credit committee formed in a Chapter 11 case can hire its own professionals, the debtor is required to pay for the fees and costs of the committee’s professionals.

Subchapter V cases also go beyond other Chapter 11 cases by allowing for relaxed plan confirmation requirements. Plans can be confirmed as long as they do not discriminate unfairly and are fair and equitable with respect to each class of claims or interests. This is under the condition that all projected disposable income of the debtor is paid into the plan for a three-to-five-year period. This is another hurdle for creditors, as many Subchapter V cases show substantial payments in terms of bonuses and compensation to insiders, which artificially decreases disposable income. Jason Torf adds, “It can incentivize debtors to put forth projections in its plan that minimize its disposable income so they can pay the least amount possible to creditors. If the debtor exceeds its income projection, the debtor gets to keep that money.”