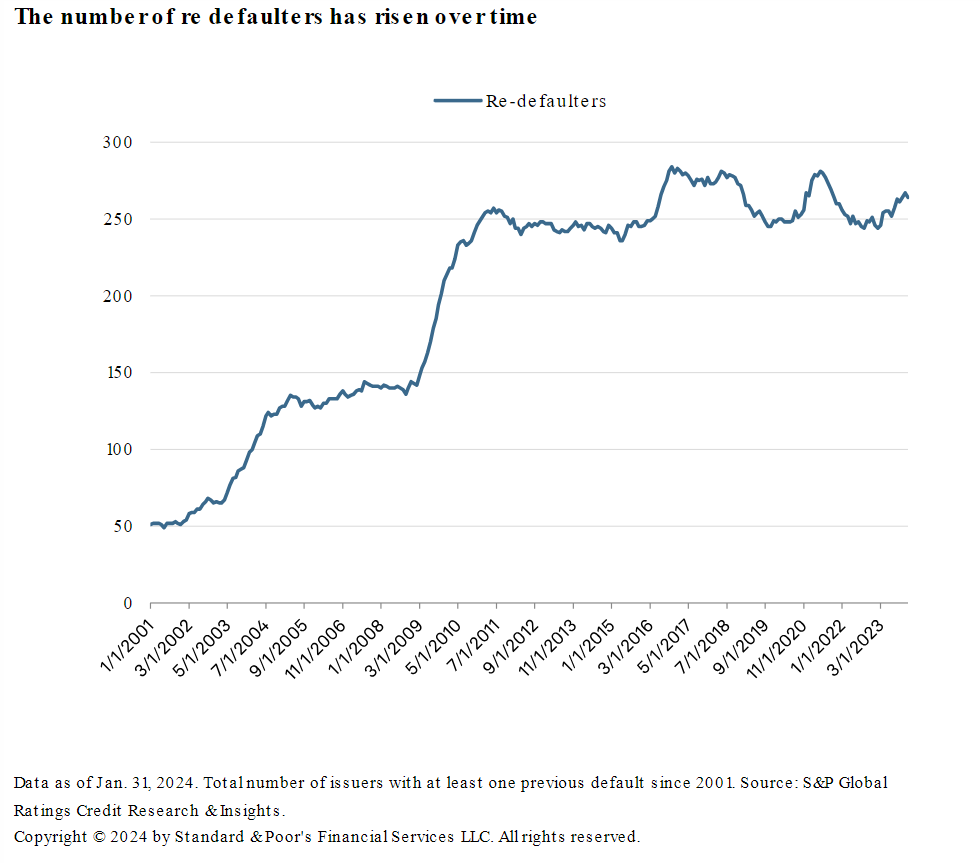

A recent surge in corporate debt defaults has raised concerns, with 2023 witnessing the fastest default rise pace since 2008. Notably, a significant portion of these defaults involve companies that have defaulted before. This trend highlights the vulnerability of issuers with lower credit ratings, who are more likely to default again on their debt obligations.

As reported by S&P, there has been a material increase in the number of weaker issuers, namely the ‘B-’ and below rating population, which has grown from only 14% of speculative-grade ratings as of December 2008 to 24% as of December 2023. This higher number of weaker rated issuers has consequently led to a higher number of defaults overall, as well as a higher number of re-defaults.

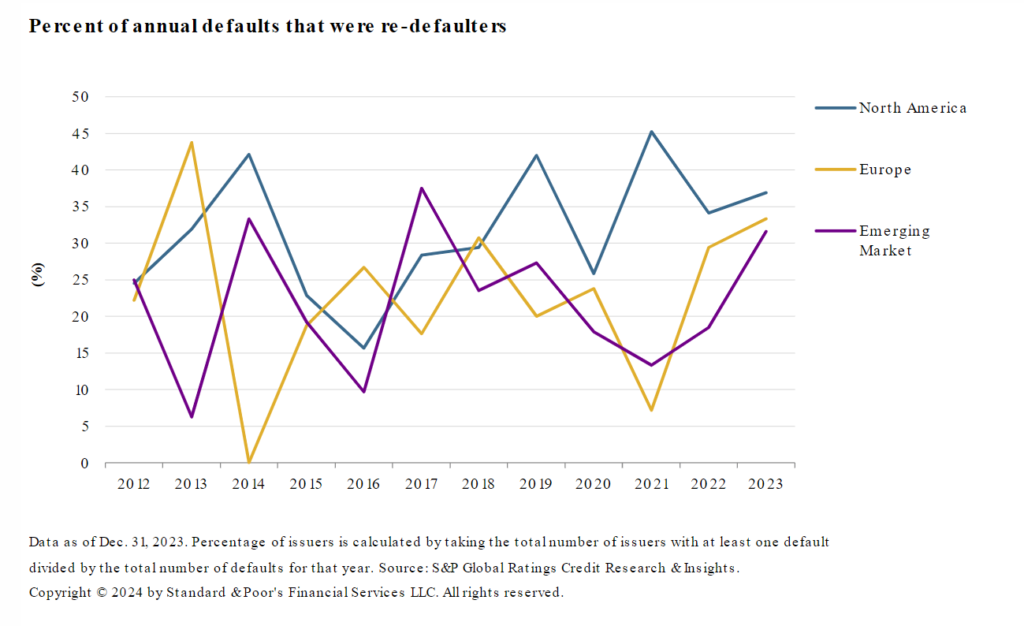

In 2023, 35% of total global defaults were by issuers who had at least one previous default, which is the second highest percentage since 2008. To make matters worse, many of those defaulting have done so more than twice. By sector, the consumer services sector led the way for re-defaulters, followed by high technologies, telecommunications, transportation, and utility.

Providing a distinction between the percentage of selective defaults and re-defaults, S&P explains that more issuers that selectively default (‘SD’) are re-rated within 12 months of defaulting, compared with those that go through a default (‘D’). A ‘SD’ rating differs from a ‘D’ rating in that an issuer may have only defaulted on one or a portion of its debt obligations, whereas a ‘D’ rating is a general payment default across the capital structure or when an entity files for bankruptcy. In the case of an ‘SD’ rating, an issuer conducts a distressed exchange, which often only provides a temporary reprieve to issuers in regaining their footing and starving off a more comprehensive (and costly) bankruptcy. Since 2008, 68% of ‘SD’s’ are re-rated within 12-months of defaulting compared with only 16% of ‘D’s. As a large majority of these issuers are re-rated within the ‘CCC+’ and below rating category (66%), they are typically highly leveraged and vulnerable to external shocks and thus, have a higher probability of defaulting again.

This trend is indictive of issuer-specific risk factors that can be exacerbated by market fundamentals, leading to additional defaults. Issuers have also become more comfortable with high levels of leverage that were initially set up during a period of low interest rates.

Companies that have defaulted in the past can be more susceptible to defaulting again. Restructuring after an initial default sometimes doesn’t properly address a company’s core problems. This is why reviewing a company’s credit character and default history is crucial when making a credit decision.