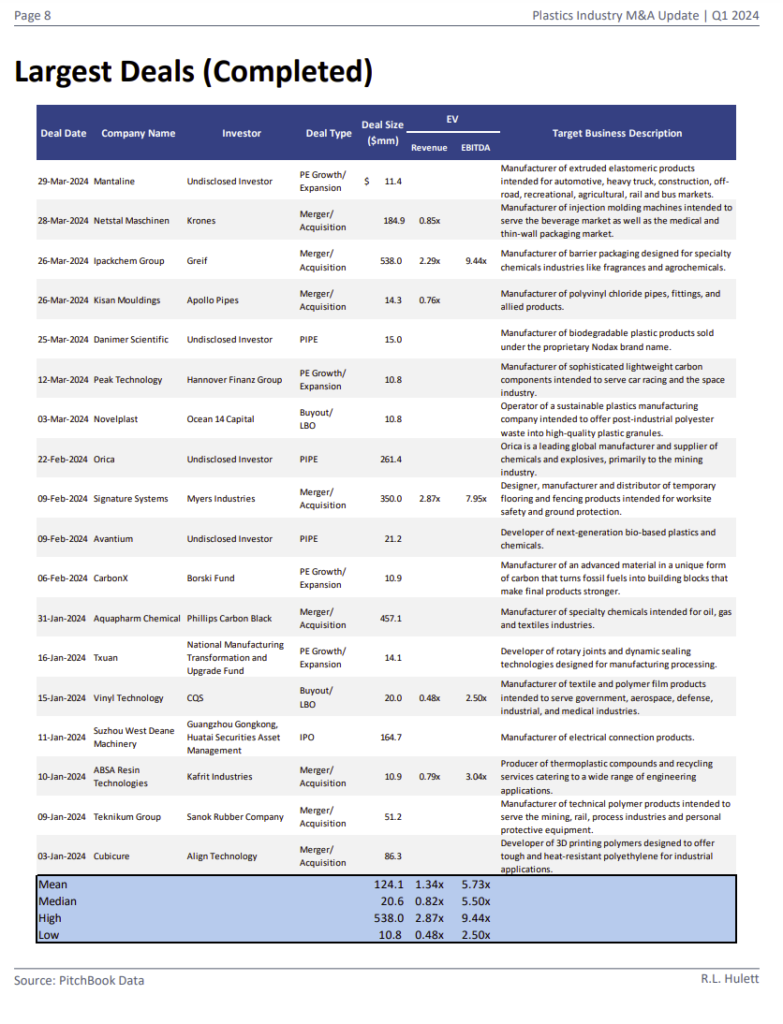

Global M&A activity fell 26% in 2023 to $2 trillion in aggregate deal value compared to $2.7 in 2022. Deal counts also fell by about 23%. S&P Global Market Intelligence reiterated that dealmakers struggled with a challenging macro environment, which included turmoil in the US banking sector, tighter borrowing costs, new regulatory scrutiny, and rising geopolitical risk.

However, a variety of factors support the global M&A market’s durability and point to optimism for the rest of this year. McKinsey & Company highlights two key drivers:

Strategic urgency: Seismic shifts in the business landscape like the rise of AI, growing environmental concerns, and a tech-savvy consumer base are forcing CEOs to adapt quickly. M&A offers a quicker path to these strategic goals compared to organic growth, which often falls short.

Abundant capital: Unlike past markets in which private equity and principal investors drove much global M&A activity, in 2023 they fled to the sidelines. PE slashed their activity 37% to $560 billion, as they were spooked by high costs of capital, uncertainty about central bankers’ plans, and regulators’ more robust scrutiny of deals. However, these players are unlikely to stay on the sidelines for long. Despite only accounting for 18% of deal activity in 2023, with over $2 trillion in unutilized capital at the end of 2023, the need for deployment and exit strategies may soon bring them back into the market, alongside corporations looking to make deals. Corporate balance sheets also remain flush with cash, making it easier to pull off big deals. As of February 2024, non-banking U.S. companies have increased their cash reserves to $6.9 trillion.

Joe Mantone, lead author of the report at S&P Global Market Intelligence, further states that lower interest rates could further invigorate dealmaking by making acquisitions cheaper to finance. A reduction in interest rates could also boost stock prices, making target companies more attractive to buy. In turn, this could entice more private companies to go public and create a more favorable environment for private equity exits, which have stalled since Q2 2022. However, the initial optimism for rate cuts in 2024 has waned. While market participants initially expected four cuts this year, recent data suggests a 71% chance the central bank will delay any cuts until September. We note the Fed held rates steady at its May 1, 2024, meeting, citing a lack of inflation progress.

Despite Global M&A deal volume falling to the lowest level in almost four years, global M&A value increased in the first quarter of 2024. S&P’s 2024 Q1 Global M&A and Equity Offerings Report showed the total value of first-quarter global M&A deals reached $594.47 billion, an 18.5% increase compared to the first quarter of 2023.

Deal activity in 2024 will likely move with broader economic conditions, but strong corporate balance sheets, a substantial backlog of pre-launch deals, and record levels of buy-side dry powder provide strong tailwinds for a recovery in the M&A markets this year.

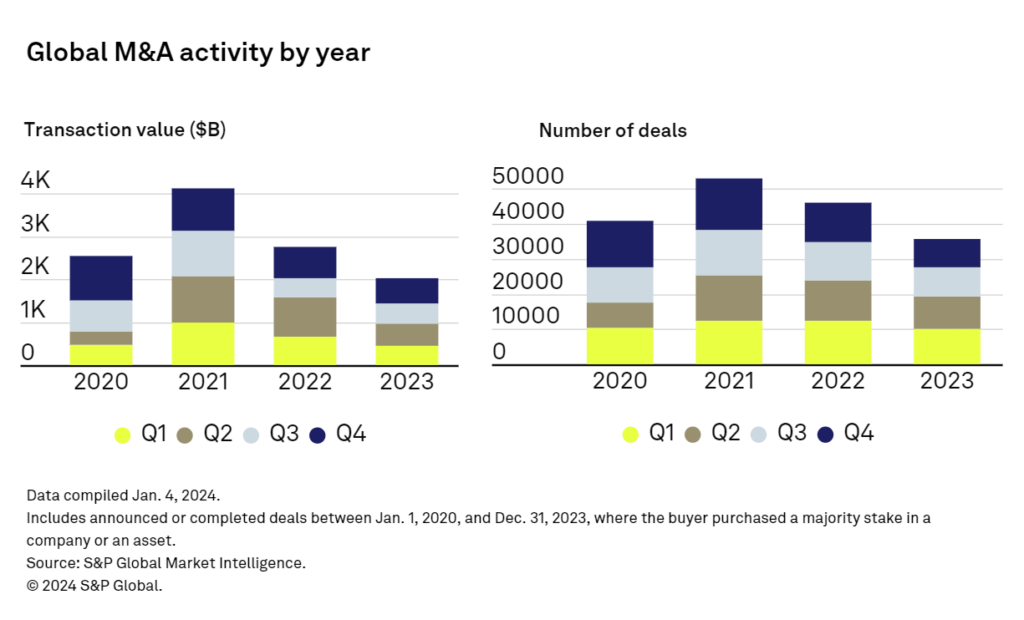

Recent Metals M&A Activity

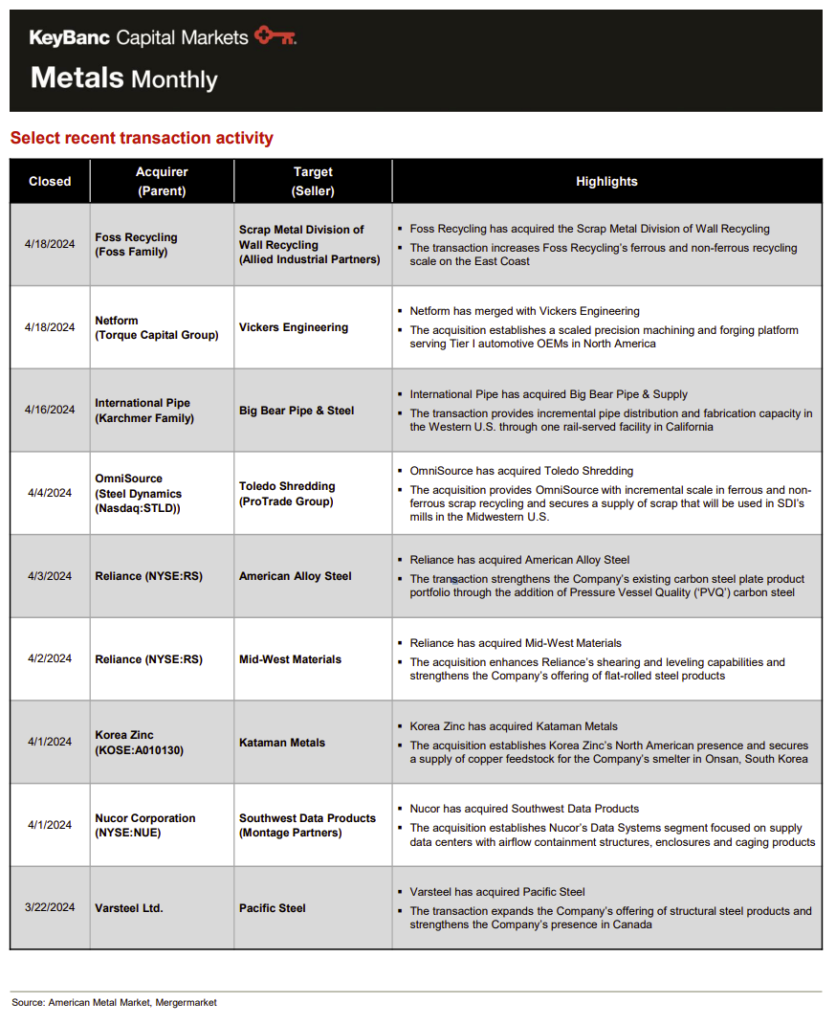

Recent Plastics and Packaging M&A Activity