Bankruptcies on the rise

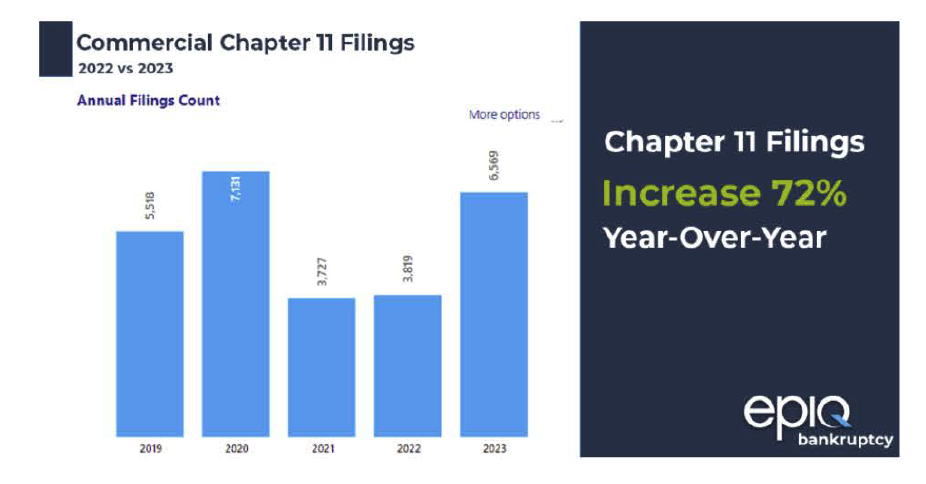

U.S. bankruptcy filings surged 18% in 2023, reaching 445,186 from 378,390 in 2022. The most dramatic increase came in commercial Chapter 11 filings, which skyrocketed 72% as companies grappled with elevated interest rates, inflationary pressures, operational difficulties, and mounting debt maturities. Small business filings, captured as subchapter V elections within Chapter 11, also experienced a substantial increase in calendar year 2023, as the 1,939 filings represented a 45% increase from the 1,334 recorded in 2022.

We expect this trend to continue in 2024, with uncertainty swirling around the pace of economic growth, in addition to tougher lending standards and growing debt loads. Struggling businesses will likely turn to bankruptcy for a financial fresh start.

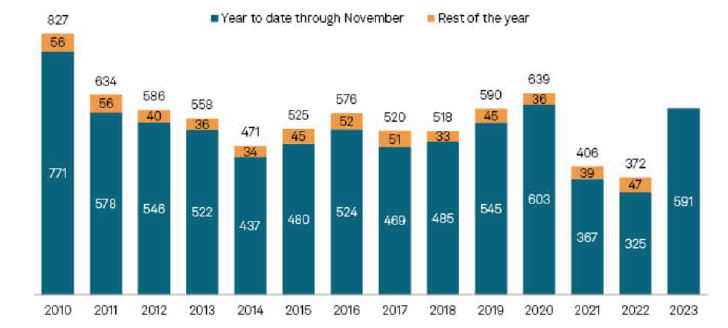

According to S&P Global Market Intelligence, there were 591 corporate bankruptcies YTD through November 2023. The year-to-date number of filings exceeds all yearly totals over the previous decade, other than 2020. It also notes consumer discretionary, industrials, and healthcare accounted for most filings, amid challenging operating conditions.

US bankruptcy filings by year

Includes S&P Global Market Intelligence-covered LIS companies that announced a bankruptcy between Jan. 1, 2010, and Nov. 2022.