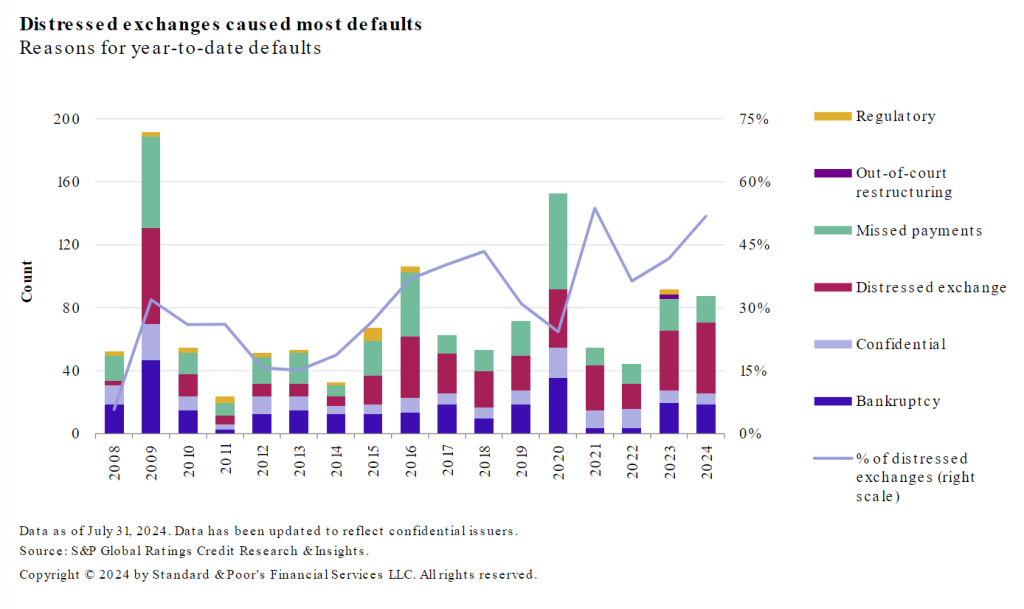

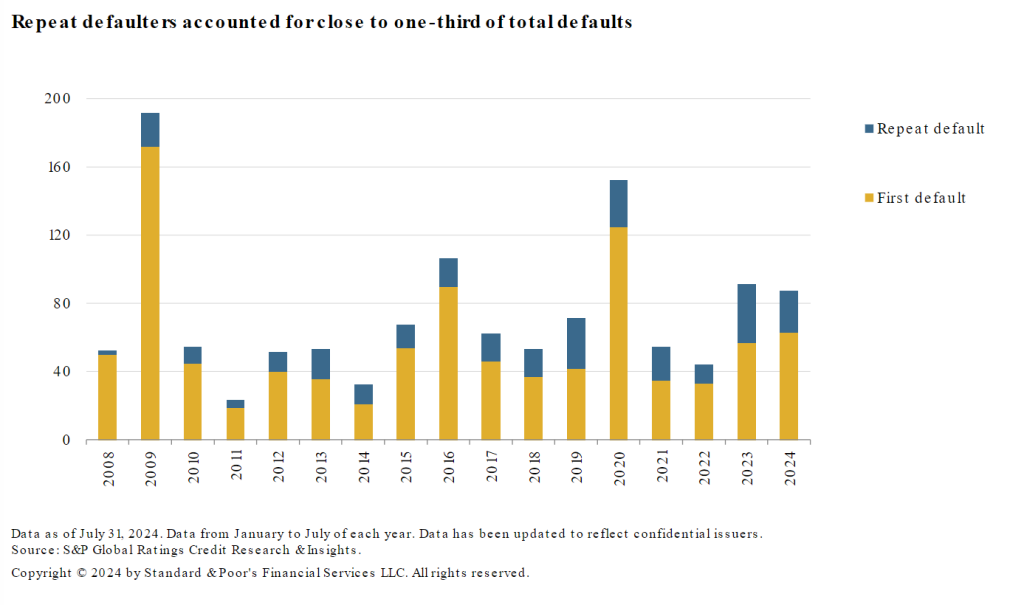

Distressed exchanges were the leading cause of defaults in July, and accounted for two-thirds of total defaults. According to a recent S&P Global Ratings report, they remain a leading cause of defaults in 2024, with 45 distressed exchanges in the first seven months of the year. The total count, which is 18% higher than in the same period last year, is at the highest level since 2009. The increase in distressed exchanges partly results from a growing number of repeat defaulters, companies that have already defaulted at least once. Repeat defaulters accounted for close to one-third of year-to-date defaults.

In its recently released global default rate report, Moody’s noted that “some distressed exchanges are just a temporary lifeline, with issuers kicking the restructuring can down the road.” Five of the month’s defaulters were re-defaulters, and four of those had previously restructured via distressed exchange. Among July’s distressed exchanges, one involved a debt-for-debt exchange, one was due to an amendment and extension, one from a recapitalization that saw some debt exchanged for a mix of debt and equity, and one was part of an acquisition.

Increasing comfortability with high leverage in their capital structure has aided in an increase in repeat defaulters in recent years. This debt was set up during and in anticipation of, sustained periods of low interest rates. Companies that have defaulted in the past can be more susceptible to defaulting again as restructuring after an initial default sometimes doesn’t properly address a company’s core problems. This is why reviewing a company’s credit character and default history is crucial when making a credit decision.