Credit Uncertainty Lingers as Small Businesses Struggle

Economic Update

Manufacturing growth in the U.S. stalled in April, falling back into contraction after a single month of expansion in March. The Institute for Supply Management (ISM) reported a Purchasing Managers’ Index (PMI) of 49.2%. The job market showed signs of moderation, with unemployment rising slightly to 3.9% from 3.8%. This translates to 175,000 new jobs added, the slowest pace in six months. Also, inflation for April cooled slightly, coming in at 3.4% compared to the prior month at 3.5%. The continued culprits for having this metric elevated are energy and housing. While this is a welcome development for the Federal Reserve, they’ll likely wait for a sustained downward trend before adjusting interest rates.

Insolvencies

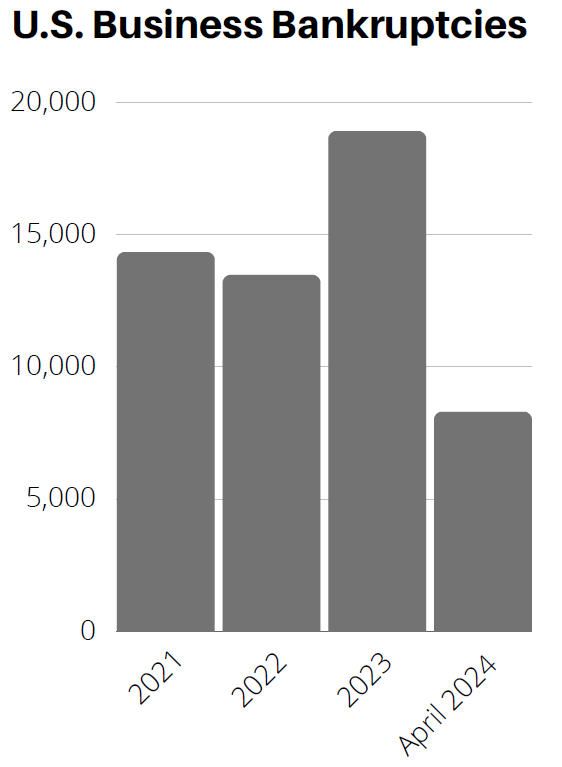

Overall, commercial filings increased by 39% for the month of April when compared to the same month in the previous calendar year. The biggest jump was that small businesses filing increased by 60%, followed by Chapter 11 by 40%, and Chapter 7 increased by 33% in April for that same time frame. The increase in bankruptcies is attributed to higher-for-longer interest rates and increasing costs across the board for businesses.

State of Corporate Credit

May brings a lot of credit uncertainty as inflation and interest rates continue to be sticky. Companies below investment grade, those considered riskier borrowers, are particularly sensitive to these factors. The first sign is payment habits typically worsen and eventually become withheld as these riskier borrowers look to conserve cash to survive. Another signal, is companies will resort to layoffs to cut costs as we are witnessing some sectors experiencing the highest levels in 14 months. We expect this trend is likely to persist as businesses grapple with the financial strain and continued deterioration in their creditworthiness.

Current & Evolving Credit Risks

Personal Guarantees

Unrated private loans continue to rise in popularity due to their uniqueness. In the lower market, private unrated loans under $10.0 million are typically backed by personal guarantees, the owner’s personal investment, and even their homes. For the even riskier borrowers’ other back stops like pledging vehicles, getting third party valuations, illiquid assets, and monthly reporting may all be required due to very poor credit quality.

Lower Market Defaults

Private credit defaults rose to 1.84% marking two consecutive quarters of increases led by the lower market. The companies with EBITDA under $25.0 million saw the largest increase with defaults almost tripling, going from .7% to 1.9%. Typically, the lower market consists of small or family-owned businesses, which are impacted the most by sudden swings in input costs as it cripples credit metrics.

Downgrades Spike

The first quarter saw downgrades up 2.6x when compared to upgrades. Forward looking indicators show that distress levels and downgrades rose slightly in April signaling future erosion of credit metrics. Additionally, global defaults are the highest since late 2022 with the United States leading with 10. Overall, the weakest companies continue to be plagued by higher debt servicing costs, which is stressing the overall credit environment.