Inflation and Defaults Remain Sticky

Economic Update

U.S. manufacturing continued its 16 consecutive months of contraction at 47.8%, down 1.3%. Job growth topped expectations with adding 275,000 jobs, which was above forecast by 75,000. The unemployment rate is at a two-year high sitting at 3.9% up 0.3% in February. Inflation for February was at 3.2% from a year earlier and core prices all rose by 0.4%. We believe the Fed will wait a bit longer before cutting rates as this latest report showed inflation is still warm.

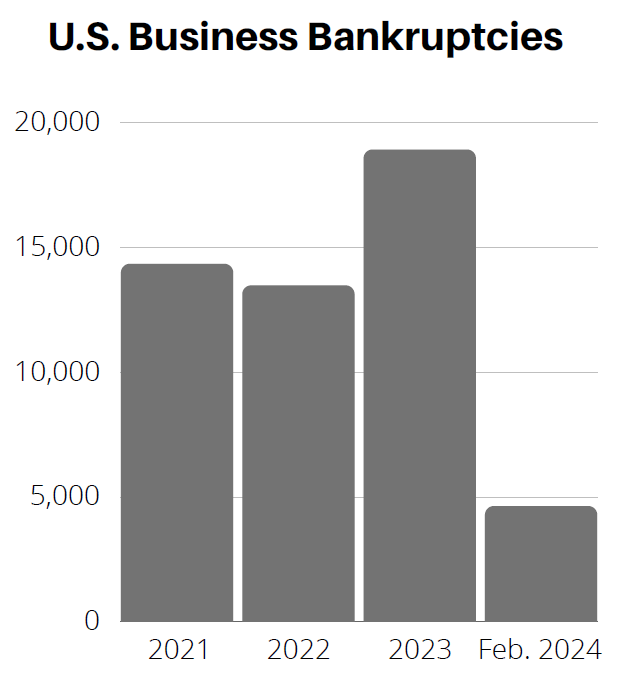

Insolvencies

Total commercial filings increased by 48% in February 2024 when compared to last year. Chapter 11 filings surged up 118% and small businesses escalated to 78% in the same timeframe. Overall, February marks 19 consecutive months that total and commercial filings have registered month over month increases in the United States. We note this double digit increase in both annual and monthly defaults will continue to tick upwards.

State of Corporate Credit

February’s loan default rate of 2.07% marks the highest point since April 2021 and surpasses the 10-year average. A concerning trend is the rise of distressed exchanges, which have become a significant contributor to overall defaults. In 2019, these exchange-related defaults comprised only 10% of the total. This figure doubled in 2020 and has remained worryingly high since: 53% in 2022, 47% in 2023, and 52% for the most recent twelve months ending in February 2024. Given the current environment of high interest rates, expensive borrowing conditions, and tight credit restrictions, these elevated default rates are likely to persist.

Current & Evolving Credit Risks

Recession Risk

The fear of a near term recession has decreased as GDP growth remains positive and the job market remains stable. We believe inflation will be sticky so rates will be elevated for longer. Thus, borrowing costs will continue to pressure debt servicing metrics and the ability to refinance.

Credit Cycle Upturn

The probability for a credit upturn for 2025 looks favorable. However, in the interim, we expect continued deterioration due to higher borrowing costs, higher prices, and weaker demand. Elevated debt leverage is in correction mode as demonstrated by elevated restructurings and bankruptcies.

Artificial Intelligence Risk

AI is being increasingly weaponized by bad actors, who are finding new ways to exploit existing communication channels. A prime example is the rise of sophisticated voice replication attacks, making it easier than ever to steal sensitive information. Employees must be hyper-vigilant to avoid these AIpowered scams, which can inflict significant financial damage. While AI offers undeniable benefits, its impact on financial risk will be a complex and evolving issue.