Slowing growth amid policy uncertainty and new conflicts

Economic Update

U.S. manufacturing contracted again in May, driven by economic uncertainty. The slowdown in new orders persists, as buyers and sellers continue to negotiate who will bear the cost of potential tariffs. As expected, the Fed kept interest rates unchanged at its June meeting, maintaining the federal funds rate at 4.25% to 4.5%. This decision comes as new geopolitical tensions in the Middle East and tariffs cloud the economic outlook. Fed officials now anticipate higher inflation and slower economic growth.

State of Corporate Credit

Risky companies are utilizing other funding venues as interest rates remain elevated and banks adopt stricter lending standards. With non-bank lenders (independent finance companies and private credit funds) surging past traditional banks, new risks are emerging. The IMF has warned that covenant-lite prevalence—70% of private credit loans—heightens default risks if economic growth falters, with over one-third of borrowers already cash-flow negative. Increased leverage, wider covenant cushions, and more complex funding structures can make it harder to react quickly when circumstances change.

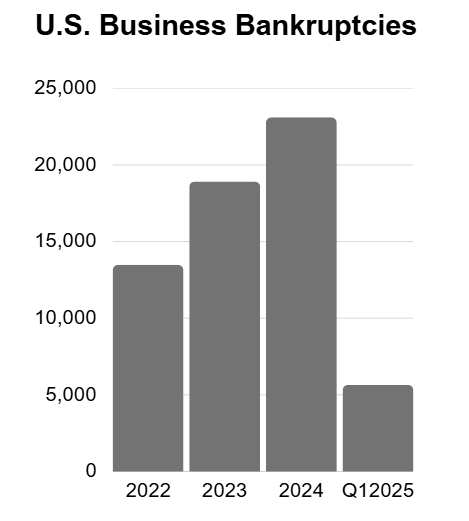

Insolvencies

The landscape for U.S. businesses is becoming more challenging, as evidenced by a 62% surge in commercial Chapter 11 filings in May. Businesses are grappling with a confluence of factors that are squeezing profit margins and liquidity. Recent high-profile filings include At Home Group, Marelli, Sunnova Energy, and Rite Aid. As companies continue to deal with high borrowing costs, renewed supply chain disruptions, and uncertain geopolitical events, we expect bankruptcy filings to remain elevated for the rest of the year.

Current & Evolving Credit Risks

Sponsors Turn to Recaps as Exits Stall

According to PitchBook data, the share of deals tied to refinancing and recapitalization rose to 30% in the three months through May 31, matching the highest proportion in at least five years. Sponsors are exploring alternative strategies for capital returns amid constrained exit conditions. While refinancing and recapitalizations offer temporary relief and operational breathing room for portfolio companies, they often fail to address underlying, unsustainable capital structures common in sponsor-backed firms. Consequently, highly leveraged companies find themselves with limited flexibility to navigate during times of economic uncertainty.

Automotive Industry Challenges

The automotive sector, already facing depressed global auto sales, is grappling with uncertain tariff policy and challenges securing rare earth supplies as China tightens its grip. This will likely affect credit quality across the sector and its suppliers. Automakers like Ford and Suzuki have already had to suspend production at some plants due to the rare earth shortage. European auto supplier association CLEPA reports that several European auto supplier plants have also shut down. The halt on rare earth exports could quickly lead to shortages and further disrupt production.

U.S. Industrial Production Fell in May

The Federal Reserve reported that U.S. industrial production experienced a larger-than-anticipated decline in May, its second such decrease in three months, suggesting a significant cooling from the robust activity observed in the first quarter. Weak factory output and business investment are anticipated for the remainder of the year, likely negatively impacting credit quality across sectors.