mounting Financial pressure on businesses

Economic Update

U.S. manufacturing activity contracted for the fourth consecutive month in June, driven by slowing orders and declining backlogs. This downturn is largely attributed to pervasive tariff uncertainty, which is causing customers to delay commitments. Tariffs continue to cause confusion and instability. The Fed is unlikely to cut rates at its July meeting. The consensus among market participants and experts is that the first rate cut is more likely to occur in September.

State of Corporate Credit

With 52 bankruptcy filings recorded between Jan. 1 and June 30, U.S.-based private equity and venture capital portfolio companies are on pace to match or exceed the full-year 2024 total of 103 in-court restructurings, according to S&P Global Market Intelligence data. Notably, PE-backed firms accounted for 14% of the 371 total bankruptcy processes initiated in U.S. courts through June 30. Mounting financial pressures are squeezing these companies, and the situation could worsen as U.S. businesses and consumers start to feel the full force of tariffs.

Insolvencies

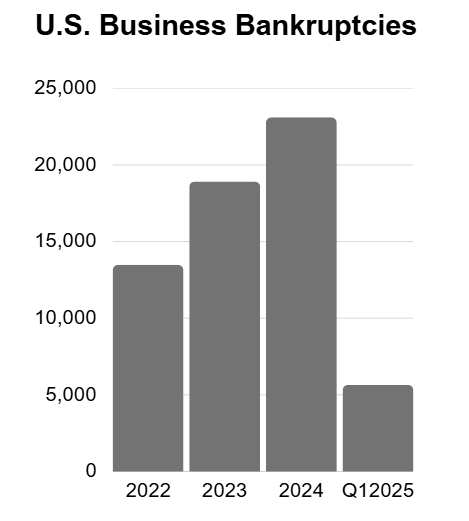

While overall commercial bankruptcy filings fell slightly in the first half of 2025 compared to last year, total bankruptcies increased 10%. Elevated input costs, high borrowing costs, and uncertain geopolitical events continue to add to growing debt loads. We further note that corporate bankruptcy filings have leaned toward reorganization over liquidation so far in 2025. Of the 371 filings in the first six months of 2025, 61.2% have sought to restructure, according to the latest S&P Global Market Intelligence data.

Current & Evolving Credit Risks

Liquidity Deteriorating

S&P reports that most U.S. companies, regardless of their credit rating, saw their cash positions weaken in the first quarter. This is largely due to the continued high cost of servicing short-term debt. The U.S. 1-year Treasury bill, a key benchmark for short-term corporate interest rates, stayed above 3.8% throughout the quarter. While this is down from over 5% in 2023 and 2024, it remains elevated compared to the sub-3% levels seen from 2010 to 2020. As companies face tighter liquidity, an increase in bankruptcies is likely.

Producer Price Index Falls, Inflation Threat Remains

The June Producer Price Index (PPI) decreased to 2.3%, below the 2.5% expectation, while core PPI also fell to 2.6% from 2.7% last month. However, the threat of future inflation remains. Current tariffs, largely at 10% for most countries, have been easily absorbed. As new tariffs of 20% and higher are implemented on other nations (following recently announced deals), these costs are likely to translate into higher inflation figures, complicating the Federal Reserve’s interest rate decision.

50% Copper Tariffs

If implemented on August 1, the proposed 50% U.S. copper import tariffs will likely disrupt the entire industry. While the U.S. possesses substantial copper reserves, its domestic refining and smelting capacity is currently insufficient to meet national demand. Since copper is a fundamental material in countless products, U.S. manufacturers will face drastically higher input costs. This will also likely lead to global copper producers rerouting their exports and a considerable divergence in market prices (COMEX vs LME).