Liquidity and Leverage Straining Credit Quality

Economic Update

U.S. manufacturing showed signs of recovery in January, rising 2.0% to a 15- month high of 49.1%, despite still being in contraction territory. Job growth remains strong, with unemployment holding steady at 3.7%; adding 353,000 jobs, which was above forecasts. Inflation for January was 3.1% down 0.3% for the month of December, but still more than expected. Although inflation is moving in the right direction, prices remain sticky, and the Fed is still away from its target of 2.0%. We expect the Fed to push rate cuts out to the back half of the year.

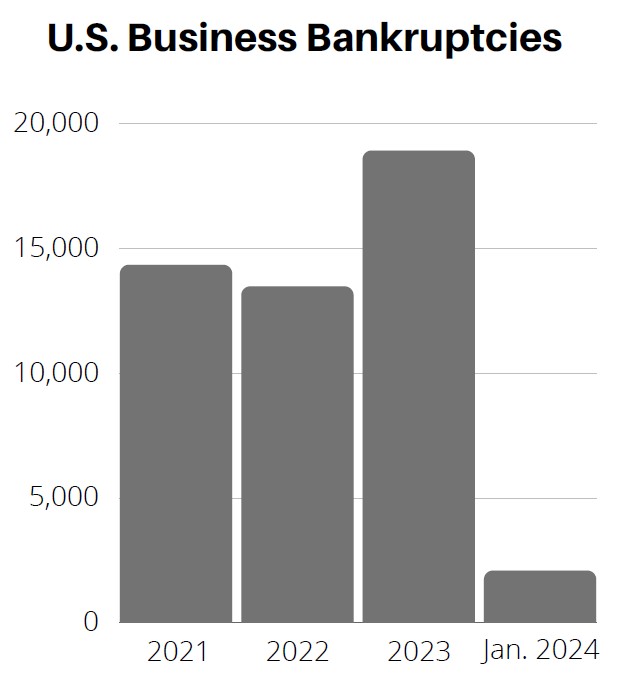

Insolvencies

Total filings increased by 17% in January 2024 when compared to last year. Chapter 11 filings were up 22% and small businesses, remaining under pressure, are up 43% in the same timeframe. We note the Canada insolvency rate has reached record highs with the most insolvencies in 36 years. They are experiencing a 41.4% increase year over year, the highest volume of insolvencies in 13 years. Overall, January marks 18 consecutive months that commercial filings have registered month over month increases in the United States. This comes as no surprise as banks tighten their lending standards and liquidity erodes, catapulting insolvencies onward and upward.

State of Corporate Credit

The number of risky borrowers is only growing with lower rated entities expanding this credit group. Downgrades are trending upward and look to be more concentrated around weaker entities, which is a concern. The correlation for weak entities and downgrades revolves around debt and negative cash flow. While improving market conditions often signal economic optimism, this doesn’t always translate to looser credit conditions. We expect downgrades to continue to outpace upgrades this year.

Current & Evolving Credit Risks

Liquidity Stressed

Private debt issuers had 45 downgrades in Q4 versus just 19 upgrades. About half of these downgrades had a common dominator of weak liquidity and almost all are backed by a financial sponsor. We note these lower rated entities will face liquidity hurdles with tighter lending standards in 2024 as the credit environment worsens. Liquidity and access to it remain a key risk trend we are monitoring right now.

Weakest Links Grow

This group of borrowers is rated B- or lower and they account for 13.9% of the overall loan market, according to S&P. This group’s default rate within one year has more than doubled reaching a peak of 14.0% from 6.0%. This is not shocking as debt levels increased by $84.0 billion or 33% in 2023 over a one-year period. This vulnerable group is very sensitive to high interest rates and increased financing costs, which will push up credit defaults at a record pace.

Incremental Loan Popularity

We have seen a rise in incremental loan issuance. For borrowers, it’s a different way to increase capital while keeping their other loans and facilities intact. Lender’s benefit as they are able request favorable terms, conditions, and amendments. The ease of attaining debt capital is an attractive approach for both parties, but credit metrics will be strained as companies continue to increase and push leverage higher.