trade friction and tariffs weigh on demand

Economic Update

Headline CPI rose 2.7% year over year, slightly below expectations, while core CPI increased 3.1%, exceeding projections. Despite persistent inflationary pressures, markets are currently pricing in a 25-basis-point rate cut in September. Markets appear to be adjusting to a stagflationary environment—characterized by rising prices and slowing economic growth. Notably, the Federal Reserve will have one more labor market report to consider before making its September decision.

State of Corporate Credit

According to the Federal Reserve’s Senior Loan Officer Opinion Survey released this month, banks reported tighter lending standards and weaker demand for Commercial and Industrial (C&I) loans across firms of all sizes during the second quarter of 2025. Weak demand was primarily attributed to reduced customer investment in plant and equipment, along with lower financing needs for mergers, acquisitions, and inventory purchases. Small firms faced more restrictive lending terms, including tighter requirements for collateral and smaller credit line sizes. While lending standards have eased slightly compared to July 2024, they remain on the tighter end of their historical ranges.

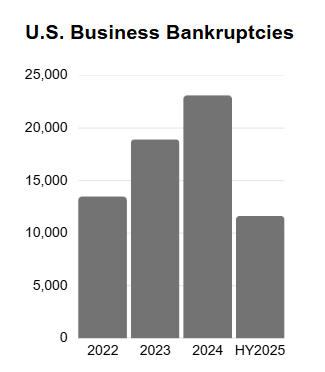

Insolvencies

Commercial Chapter 11 filings totaled 911 in July, a 78% increase year over year. Overall volumes are steadily climbing back toward pre-pandemic levels, and we anticipate this growth will continue throughout the remainder of 2025 and into 2026, driven by persistent economic pressures. S&P reported that U.S. corporate bankruptcies in July reached their highest monthly volume since 2020. Companies are contending with elevated interest rates as uncertainty from U.S. tariff policy pressures costs and supply chain resilience.

Current & Evolving Credit Risks

Section 232

On June 4, 2025, the Section 232 tariff rate was increased to 50%, from 25%, for all imports of steel and aluminum. A stacking mechanism also applies, for derivative products 50% tariff is levied on the steel or aluminum content, while a reciprocal tariff rate is applied to the remaining value of the product. On August 15, the Commerce Department released an updated list of 407 steel and aluminum-containing products that will be subject to these national security tariffs, including certain equipment and components. These duties went into effect on August 18, 2025, with no exception for goods in transit. Meanwhile, negotiations between the U.S. and key trading partners—including mainland China, Canada, and Mexico—are ongoing. There are no indications that these tariffs will be lifted or reduced in the near term. These levies are raising input costs across key sectors such as automotive, packaging, and manufacturing, leading to higher consumer prices, softening demand, and layoffs.

50% Copper Tariffs

The U.S. copper market saw its sharpest one-day price drop on record as COMEX copper futures plunged 22% following the White House’s July 30th announcement that refined copper would be excluded from the 50% import tariff on copper products. The tariff applies only to semi-finished and copper-intensive goods, excluding refined copper and scrap. The ability of domestic semi-fabricators to scale production will be a key swing factor in rebalancing copper flows and stabilizing the market in 2025. However, it may take several months for global markets to fully redistribute copper inventories and normalize trade flows.