U.S. Corporate Bankruptcies Surge in Q3 2024: Economic Pressures Drive Record Filings

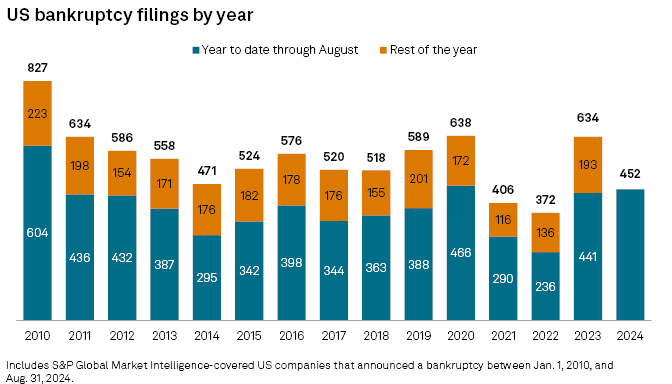

U.S. corporate bankruptcies have surged significantly in the third quarter of 2024, marking one of the sharpest increases seen in over a decade. This trend, which has been building throughout the year, is driven by a combination of factors, including rising interest rates, high operational costs, and lingering economic challenges from the COVID-19 pandemic.

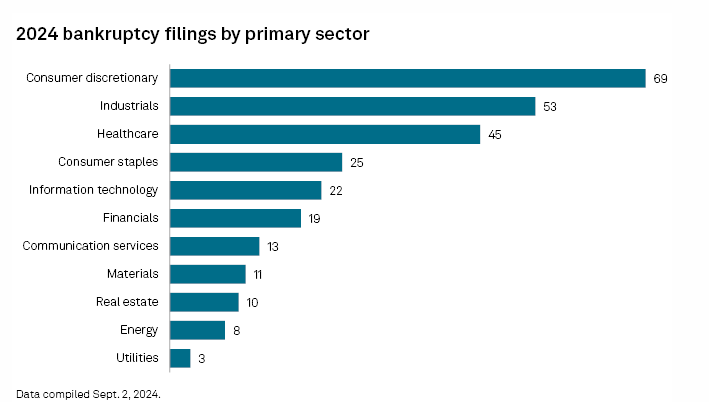

As of June 2024, the number of corporate bankruptcy filings reached levels not seen since the early months of the pandemic in 2020. By August, the situation had worsened, with a notable 17% increase in bankruptcies from the previous month. This spike has been most pronounced in sectors like consumer discretionary and healthcare, which have historically carried higher levels of debt and are more vulnerable to economic downturns.

High-profile bankruptcies this year include major retailers like LL Flooring, Delta Apparel and healthcare companies struggling with the increased financial pressures. Analysts warn that this trend may continue into 2025, especially for companies with weaker balance sheets, as the economic environment remains challenging. The broader implications of these bankruptcies are concerning, as they could signal broader economic stress and potentially lead to tighter lending conditions, which would further strain small businesses and slow down economic recovery. This rise in bankruptcies highlights the growing financial strain on U.S. companies and the potential for prolonged economic turbulence as the year progresses.

In July and August 2024, U.S. corporate bankruptcies continued to escalate, reflecting the ongoing economic stress faced by many businesses. July saw a substantial rise in bankruptcy filings, with a significant number of companies succumbing to financial pressures exacerbated by higher interest rates and lingering supply chain disruptions.

In July alone, corporate bankruptcies surged, driven by companies across various sectors, including retail, healthcare, logistics and manufacturing. The consumer discretionary sector, in particular, saw a sharp increase in filings, with companies that rely heavily on consumer spending struggling to stay afloat amid tightening credit conditions and weakened consumer demand.

By August 2024, the trend had intensified, with a 17% increase in bankruptcy filings compared to July. This marked one of the highest monthly increases in corporate bankruptcies for the year. Key factors contributing to this rise included the Federal Reserve’s ongoing interest rate hikes, which have significantly increased borrowing costs, and the diminishing effects of pandemic-era relief measures. Companies with substantial debt burdens, particularly those in the retail and healthcare sectors, were among the hardest hit.

During these months, several notable bankruptcies occurred, including that of Paramount Group Ltd. and Avon Products Inc, both of which had been struggling with declining revenues and increasing costs. Additionally, the healthcare sector saw a wave of bankruptcies, particularly among senior care and pharmaceutical companies, which faced mounting financial difficulties due to increased regulatory pressures and rising operational costs.

Overall, the July and August figures suggest that U.S. corporate bankruptcies in 2024 could surpass those seen in any year since the aftermath of the 2008 financial crisis, barring the peak during the COVID-19 pandemic. This surge in bankruptcies is a clear indicator of the challenges many businesses are facing in the current economic environment, and it raises concerns about the potential for broader economic disruptions as these financial pressures continue to mount.

Source: S&P Global Market Intelligence, Marketplace, Visual Capitalist

6 Obstacles to Sales Expansions and How to Solve Them

Challenge 1: Being Agile & Staying on Top of Market Changes:

Continuous market research is critical. That means paying attention to what your competitors are doing, engaging with your customers and employees about what you’re doing right as well as potential pain points, and having the right technology in place to regularly monitor customer trends. Paying close attention to customer behaviors and preferences and your day-to-day market performance allows your evolution to be proactive versus reactive. But how do you access the most current data about customers, prospects, and markets? How can you more quickly and accurately interpret that data to make it actionable?

Solution:

With the right information tools, you can look closely at the financial stability of your clients and track your portfolio risk. That data, when paired with economic intelligence, market trends and industry risk analysis, helps you make informed and accurate business decisions. Allianz Trade’s trade credit insurance interface allows users to evaluate credit risk and review the financial health of potential trading partners.

Challenge 2: Effective Cash Flow Management

To survive and grow in a challenging market, your business needs to maintain its cash flow so you have the capacity to invest in opportunities as they arise. Shortening your real payment period, maximizing supplier credit, screening current and potential customers for credit risk, making clear agreements about payment terms, and regularly communicating with your customers and suppliers about cash flow concerns are important.

Solution:

By monitoring existing and prospective clients, as well as overall market and industry trends, you’ll be aware of potential risks to your cash flow. Maximizing reliable customer relationships and setting clear payment terms to customers, partners, and suppliers based on this information will help stabilize your cash flow.

An effective way to better manage cash flow is to purchase accounts receivable insurance (also known as trade credit insurance). Trade credit insurance acts as a safety net to protect your business from non-payment of your accounts receivable. This frees you from maintaining bad debt reserves and helps you protect your capital, maintain your cash flow and secure your earnings while extending competitive credit terms to your customers.

Challenge 3: Expanding Existing Customer Relationships and Taking on New Ones

Customer relationships drive business growth. In challenging times, you have to work harder to keep current customers engaged and satisfied while exploring new ways to grow those established relationships. Becoming too conservative with credit limits can be a barrier to that growth.

When it comes to establishing new customer relationships in uncertain times, you have to be wary of customers who have been with a competitor for a while who suddenly approach you. Could their desire for a change actually mean they have hit a credit limit with your competitor? With regard to expanding business with existing customers, you have to walk a fine line between offering enhanced credit terms or staying with a conservative credit limit.

Solution:

Regularly monitoring your existing customers’ behaviors and engagement can help you identify opportunities to both strengthen the relationship and explore potential growth. The Allianz Trade SmartView platform offers a risk-monitoring service for customers that provides immediate visibility into trade receivables for enhanced risk and opportunity management. You gain valuable insight into the financial health of your customers via a wide range of risk reports. Plus, you can also keep track of your customer’s creditworthiness and capture growth opportunities. SmartView is available via the online trade credit insurance policy management portal.

Challenge 4: Keeping Supply Chain Running

Weaknesses in supply chains, especially internationally, came into clear focus in 2020 as the world scrambled to deal with COVID-19. There is a clear need for more diversification of supply chains, as well as actionable data and insights, to avoid the drastic disruptions, so many have experienced in the last year.

In a 2020 global supply chain survey, 94% of companies surveyed in the U.S., the UK, France, Germany, and Italy reported a COVID-19-induced disruption to their supply chains, with one out of five reporting a “severe disruption.” U.S. companies stand out, as 26% reported a “severe disruption.” Without a stable and reliable supply chain, you cannot meet the demands of existing customers, let alone grow.

Solution:

First, working with a large and diverse network of suppliers, when possible, gives you a way to deal with disruptions affecting a single supplier. Looking beyond immediate needs when it comes to inventory and preparing for unforeseen challenges like those posed by the pandemic are now a clear need. Technology that enhances your sales forecasting capabilities so you can prepare for how these projections could impact your supply chain, and data-driven resources that offer clear visibility into your supply chains, can help you stay agile and proactive.

Challenge 5: Standing Out from Competitors

Standing out from your competitors is always important in the quest to grow your business, but it’s become even more critical in these challenging times. Reliability, responsiveness, flexibility and ongoing engagement with customers are essential to maintaining customer loyalty and attracting new prospects.

Solution:

Understand the areas in which your company excels, and engage current and potential customers by emphasizing the value you can bring to them in these areas. The ability to quickly predict, identify and respond to customer needs – building upon trends and shifting customer behaviors and preferences – will put you at an advantage.

Trade credit insurance combines a robust commercial credit database with insurance to give companies the confidence they need to safely grow with accounts poised to do well. It allows your business to increase limits with customers and suppliers as required for that growth with minimal risk and enhanced agility and flexibility. That willingness to grow plus more time to focus on building your brand and engaging with customers can set you apart from your competitors.

Challenge 6: Building a Strong Sales Pipeline

In these challenging times, it might seem as if the need to hold on tightly to existing business drastically outweighs the need to expand. However, building a strong sales pipeline is key to your continued growth. At the same time, you don’t want

to focus on less-than-ideal leads or prospects that may increase your company’s financial risks. In addition, if your past sales-generation plan has relied heavily on in-person meetings and travel, you’re likely to have to rethink your strategies in favor of digital and virtual engagement.

Solution:

You need insights into the behaviors and trends of both current customers and prospects in your market to determine where to direct your sales pipeline. Once you’ve identified prospects with strong potential, you can align your marketing efforts and contacts to target those specific audiences and develop engagement opportunities that respond to their needs.

Trade credit insurance can help you build a strong sales pipeline in a number of ways. You’ll have confidence that you will be paid for what you sell, so you can offer better terms and raise credit limits to grow sales and enhance customer relationships. You can more aggressively grow sales with a key customer without the worry of concentration risk. If you want to expand to foreign markets, trade credit insurance can help you make strategic credit decisions and offer competitive terms overseas, eliminating cash in advance or letters of credit.

Source: Allianz Trade

Credit Tidbits

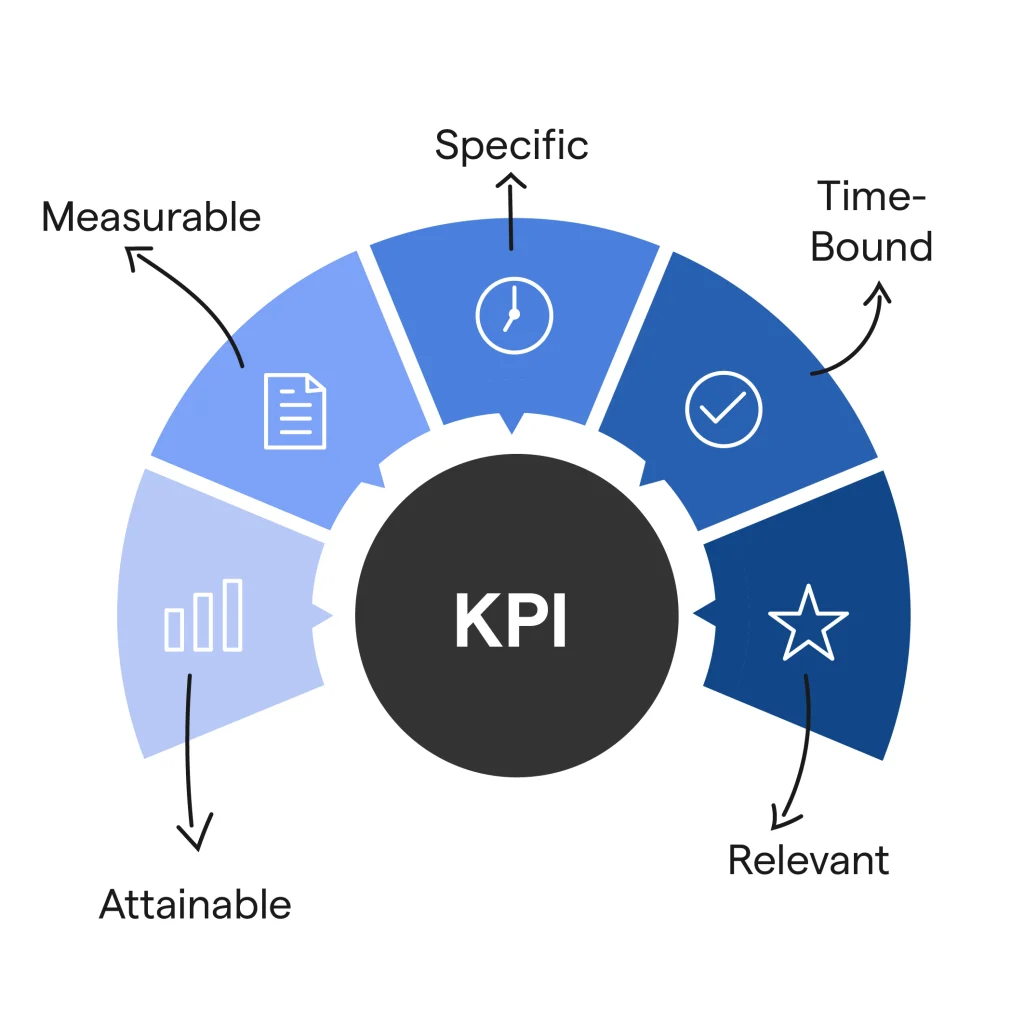

Five Financial KPIs to Help Prevent Payment Defaults

Days Sales Outstanding (DSO):

This KPI measures the average number of days it takes for a company to collect payment after a sale. A lower DSO indicates that the company is collecting receivables quickly, which improves cash flow and reduces the risk of payment defaults. Monitoring DSO helps identify potential collection issues early on, allowing for timely interventions.

Current Ratio:

The current ratio compares a company’s current assets to its current liabilities, providing insight into its ability to cover short-term obligations. A ratio above 1 indicates that the company has more assets than liabilities, suggesting it is in a good position to meet upcoming payments. Regularly tracking the current ratio can help ensure that liquidity remains sufficient to avoid defaulting on payments.

Credit Utilization Ratio:

This KPI tracks the percentage of available credit that a company is using. A high credit utilization ratio may indicate that the company is over-leveraged and relying too heavily on borrowed funds, which could strain cash flow and increase the risk of payment defaults. Keeping this ratio in check is essential for maintaining financial stability.

Cash Flow from Operations:

This metric measures the amount of cash generated by a company’s core business activities. Positive and stable cash flow from operations indicates that the company is generating enough cash to meet its financial obligations, including debt repayments. Monitoring this KPI helps ensure that the company has the necessary liquidity to prevent payment defaults.

Accounts Receivable Turnover:

This KPI measures how efficiently a company is collecting its receivables by tracking the number of times accounts receivable are collected during a period. A higher turnover rate indicates that the company is effectively managing its credit policies and collection efforts, which reduces the likelihood of overdue payments and potential defaults.

Source: Dun and Bradstreet

Global Commercial Credit and ProfitGuard Honored as Crain’s 2024 Best Places to Work in Southeast Michigan

Global Commercial Credit & ProfitGuard Holiday Party

We are thrilled to announce that both Global Commercial Credit/ProfitGuard have been recognized as part of Crain’s 2024 Best Places to Work in Southeast Michigan. This prestigious honor reflects the commitment of our teams to foster a positive, and dynamic work environment that meets the expectations of our employees.

At Global Commercial Credit and ProfitGuard, we believe that our success is driven by the people who work here. From the innovative solutions we provide to our clients to the collaborative spirit that defines our workplace culture, this award is a testament to the dedication, passion, and hard work of each team member.

Being named among the best places to work in Southeast Michigan is not just an accolade—it’s a reflection of the values we hold dear. We are proud to create a work environment where everyone feels valued, supported, and empowered to reach their full potential.

As we celebrate this achievement, we extend our heartfelt thanks to all of our employees for making Global Commercial Credit and ProfitGuard truly special places to work. We look forward to continuing this journey together, setting new benchmarks for excellence and growth in the years to come.

Congratulations to all!