Cornerstone Research’s recent report highlights a surge in large corporate bankruptcies from late 2023 through mid-2024. There is further evidence of a continued trend as shown by recent filings by American Tire Distributors, True Value Company, Accuride, Wheels Pro, Tupperware Brands, and Big Lots to name a few.

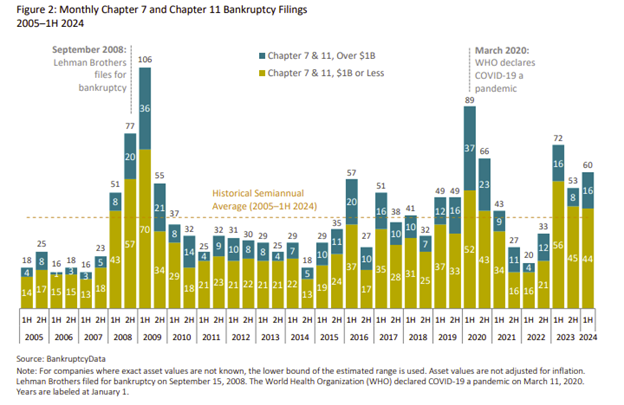

The report, Trends in Large Corporate Bankruptcy and Financial Distress—Mid-year 2024 Update, reveals a notable increase in Chapter 7 and Chapter 11 filings among public and private companies with assets exceeding $100 million. Over the past 12 months (2H 2023–1H 2024), the number of filings rose by 8%. This figure is also 43% higher than the annual average of 79 observed from 2005 – 2023. Notably, 60 of these bankruptcies were recorded in the first half of 2024, nearly 50% above the semiannual average of 40 filings between 2005 – 2023.

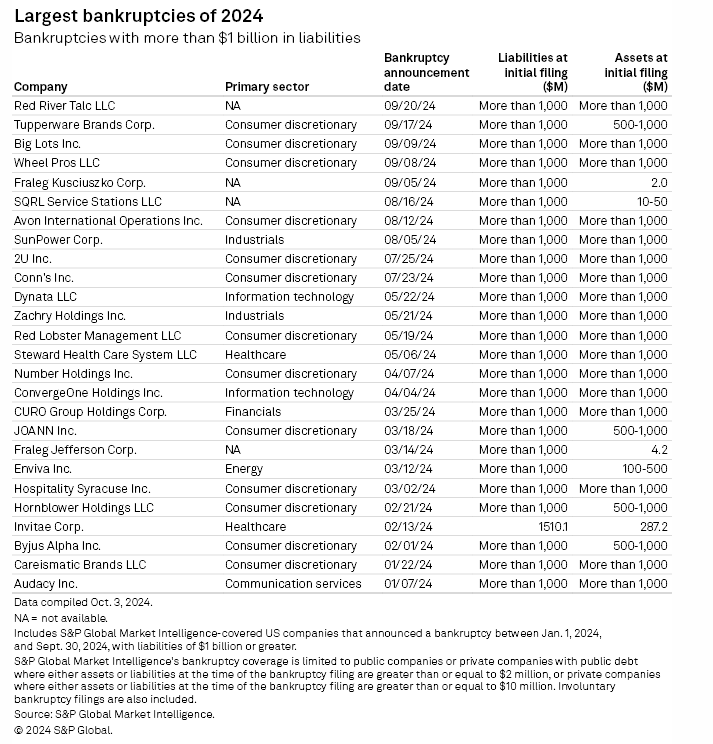

In the first half of 2024, the number of mega bankruptcies—those filed by companies with over $1 billion in reported assets—reached their highest half-year numbers since 2020. The largest bankruptcy in the last 12 months was filed by WeWork Inc. ($15.1 billion in assets at filing). In 1H 2024, the largest bankruptcy filing was filed by Enviva Inc. ($2.9 billion in assets at filing). According to the Private Equity Stakeholder Project (PESP), private equity firms played a role in 11 of the 17 (65%) largest US corporate bankruptcies during the first half of 2024.

Reasons for the uptick include:

- Rising costs due to high inflation and interest rates

- Lingering impacts of COVID-19

- Increased competition for the company’s products or services

- Debt accumulation

- Logistical and supply chain issues caused by the Russia-Ukraine war

- Unsuccessful strategic initiatives

“The recent rise in large corporate bankruptcies, with an 8% increase in filings over the past 12 months, reflects the challenging economic environment many major companies have been navigating amid high inflation and interest rates,” said Matt Osborn, a principal at Cornerstone Research and coauthor of the report. “As the economic landscape continues to evolve, it is clear that the rising costs, lingering effects from the COVID-19 pandemic, and increased competition have continued to take a toll on many large and established companies.” Consistent with prior years, Delaware and the Southern District of Texas continued to be the two most common venues for large company bankruptcy filings.

The notion that large corporations are “too big to fail” is a persistent misconception. While it’s true that some of these companies hold significant economic power and have greater access to financial resources, their size does not guarantee immunity from bankruptcy. We expect this bankruptcy trend to continue in the near term before stabilizing in 2026.