Heightened Economic Uncertainty

Economic Update

U.S. manufacturing contracted in April for the second month in a row, driven by weakened demand and output. While inputs strengthened (likely a temporary effect of tariffs), inventory growth is not a positive sign when demand is moving in the opposite direction. Rising prices, particularly for companies facing tariffs, supply shortages, and a weaker dollar, are fueling anxieties. In line with expectations, the Fed held rates steady at its May meeting. Fed Chair Powell indicated the central bank feels no urgency to lower interest rates.

State of Corporate Credit

The April 2025 Senior Loan Officer Opinion Survey (SLOOS) indicated a tightening of lending standards and weaker demand for commercial and industrial (C&I) loans to businesses in the first quarter of 2025. Banks reported reducing maximum credit line sizes, increasing risk premiums, tightening loan covenants and collateralization requirements, and more frequently using interest rate floors across businesses of all sizes. Weaker demand stemmed from decreased customer investment in plant or equipment and reduced financing needs for mergers or acquisitions. Economic uncertainty and industry headwinds will likely conitnue to play a role in tighter lending standards.

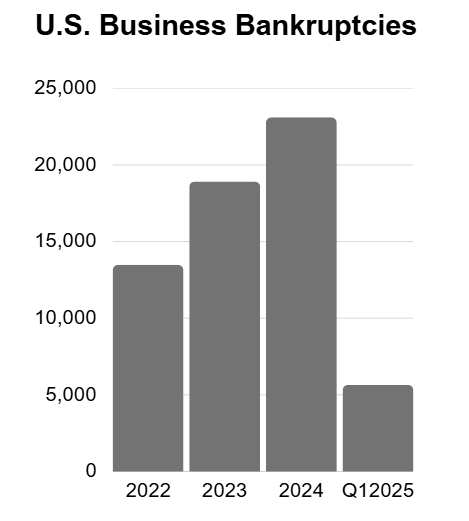

Insolvencies

U.S. commercial chapter 11 bankruptcy filings decreased 20% in April 2025, while small business filings, captured as subchapter V elections, increased 4%. This highlights persistent distress among smaller businesses who are struggling to navigate market uncertainty. In Canada, CCAA filings remained consistently high throughout most of 2024, experiencing only a brief dip in the second half. The manufacturing and retail sectors were the primary drivers of this elevated activity, likely influenced by competition, supply chain issues, uncertainty surrounding U.S. tariffs, interest rates, and the weak Canadian dollar.

Current & Evolving Credit Risks

Cargo Theft on the Rise

Cargo theft surged in 2024, costing an estimated $455 million in losses. Verisk CargoNet documented 3,798 incidents, a significant 26% increase from 2023, with Texas and California experiencing the most pronounced spikes. Most targeted cargo types include food/beverage, electronics, household, automotive, and copper. Notably, strategic theft is on the rise, which is the process of fraudulently impersonating legitimate carriers, brokers, or shippers. Implementing operational risk management solutions and having insurance is vital to help protect your business.

Aluminum Sector Dynamics

The U.S. imported 70% of its overall primary aluminum demand from Canada in 2024. Despite U.S. tariffs intended to boost domestic production, the nation lacks sufficient capacity to meet its needs. The longer these tariffs are in place, its likely to shift trade flows and keep aluminum prices elevated. Notably, the four active U.S. smelters, two operated by Alcoa and two by Century, have not indicated plans to increase production or restart idled capacity. Prolonged tariffs will likely negatively impact construction, automotive, and packaging and its supply chains. Alcoa also stated the tariffs are costing the company $425 million annually.

Tariff Risk

According to S&P data, 15% of issuers are at risk of a negative rating action in the next year if tariff costs or slower demand weaken credit ratios. Companies most at risk are speculative-grade borrowers who have narrow operating footprints, cyclical end markets, and direct import tariff exposure.