Recession Risk on the Rise

Economic Update

For February, the U.S. manufacturing rate was 50.3% on the ISM Index, 0.6% lower than the January reading, but still in expansion territory after 26 consecutive months of contraction. The unemployment rate increased slightly to 4.1% in February, adding 151,000 jobs. However, these figures are expected to shift as federal job cuts are fully realized and government hiring slows.

State of Corporate Credit

Payment-in-kind (PIK) interest has become a prevalent feature in private credit loan agreements, especially among rated issuers, as borrowers increasingly leverage it to preserve cash. KBRA (a credit rating agency) observes that PIK has become deeply embedded in the market, although lenders would prefer it to be more flexible and negotiable. While PIK has helped private credit markets attract issuers from the broadly syndicated loan market, it has drawn criticism for potentially masking underlying financial issues, especially when used excessively.

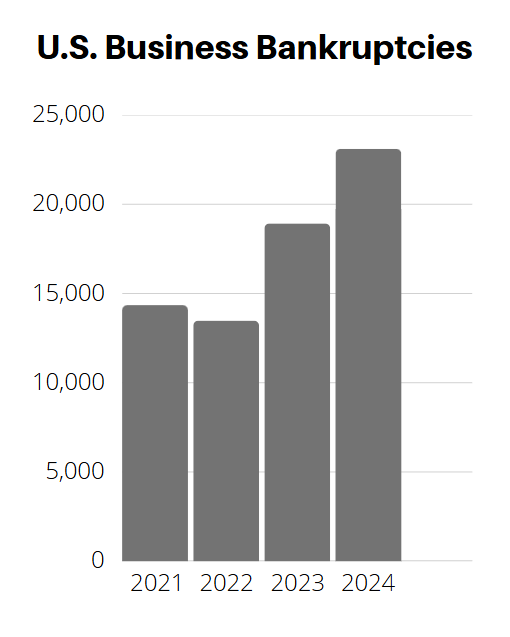

Insolvencies

U.S. corporate bankruptcy filings dropped by 42% in February 2025 compared to the previous year. However, last February’s figures were skewed by the inclusion of two large commercial Chapter 11 filings, which inflated the total. Despite the overall decline, bankruptcies in the industrials and consumer discretionary sectors surged in February. This trend is expected to persist as businesses contend with new tariffs, along with ongoing challenges like high interest rates, inflation, tighter lending conditions, and geopolitical tensions.

Current & Evolving Credit Risks

Public Company Defaults

The average risk of default for US public companies reached a post-global financial crisis high of 9.2% at the end of 2024 and is predicted to remain elevated throughout the year, according to forecasts by Moody’s Asset Management Research team.

Economic Fears

Recession probabilities priced into the markets have risen, with small-cap stocks, bonds, and base metals signaling the highest risks. The Russell 2000 now reflects a 48% chance of contraction, a significant jump from just 1% in November. At the same time, five-year Treasuries and base metals suggest recession odds above 50%, while broader equity and credit markets remain relatively subdued. JP Morgan Chase and Goldman Sachs recently raised recession risks for this year to 40% and 20% respectively, and Morgan Stanley revised GDP growth to 1.5% for 2025, pointing towards stagflation.

Tariff Uncertainty

Continuous threats of tariffs among the North American trading partners is creating market uncertainty. The 25% tariffs that were recently placed on Mexico and Canada were postponed a second time for goods that fall under the USMCA trade agreement. Given the complexity of trade regulations, economists predict that businesses will hold off on orders and delay investments until there is more clarity.