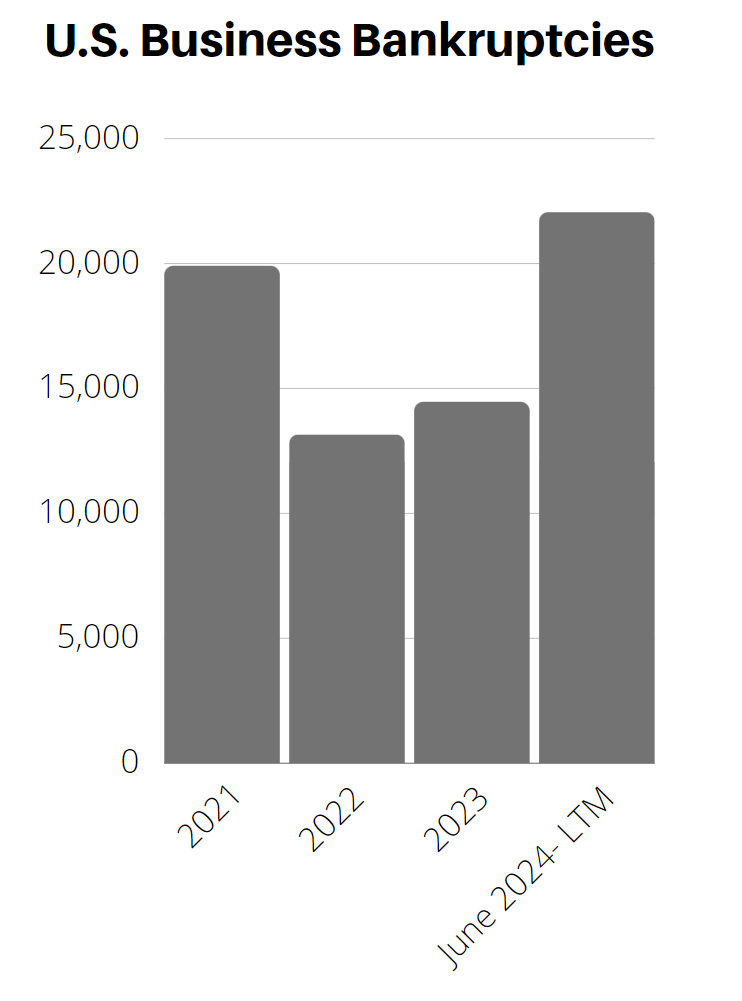

High Profile Bankruptcies Continue to rise

Economic Update

For August, the U.S. manufacturing rate was 47.2% on the ISM Index, an increase of 0.4% from the previous month. Any reading under 50.0% is contractionary, marking five consecutive months of declines and the 21st time in the last 22 months. While U.S. manufacturing activity contracted slower compared to last month, demand continues to be weak, caused by current federal monetary policy and election uncertainty. The unemployment rate fell to 4.2% in August, adding 142,000 jobs. However, job growth over the prior two months was revised down by 89,000 jobs. This has positioned the fed to cut rates in September, but the pace and rate cut size are still in question.

State of Corporate Credit

Downgrade activity remains primarily concentrated on high-risk entities, rated in the ‘B-‘ and ‘CCC/C’ levels. Liability Management Exercises (LMEs), or “soft” defaults in the form of out-of-court distressed exercises climbed to an all-time high of 34 in August. With interest rates remaining elevated, companies are seeking breathing room outside of bankruptcy courts ahead of expected interest rate cuts. However, data shows that a significant portion of these issuers will return with a conventional default, as interest rate burdens on floating-rate debt, more expensive credit conditions, and economic headwinds will continue.

Insolvencies

Commercial chapter 11 filings increased 8% in August 2024 when compared to August 2023. The rise in bankruptcies will continue, as US companies struggle with sluggish consumer spending in certain categories, elevated interest rates, geopolitical uncertainty, and election uncertainty. Recent high-profile bankruptcies include solar technology SunPower Corp, wheel manufacturer Wheel Pros LLC, discount retailer Big Lots, and flooring provider LL Flooring Holdings Inc.

Current & Evolving Credit Risks

Pressure on Steelmakers

With Chinese exports surging and steel pricing trends heading back to pre-pandemic levels, credit metrics may begin to weaken for steelmakers. Except for cold rolled, most grades have sustained double-digit percentage decreases year over year.

Industrial Sector Risk

A recent Coface publication indicated that several sectors remain high risk for defaults in North America including automotive, construction, metals, paper, transport, and wood products.

Automotive Market

Softening demand in key automotive markets, such as the U.S., China, and Europe, is beginning to impact both auto manufacturers and their suppliers. Suppliers are facing tighter margins as demand wanes and investment costs rise. Compounding this issue, intense price competition among car manufacturers is placing additional strain on suppliers, leading to extended billing cycles and further eroding profit margins. For smaller suppliers, who already work with narrow margins, these pressures may become untenable, potentially driving them out of business due to unprofitability.