Sticky inflation and higher-for-longer interest rates are squeezing private equity portfolio companies and pushing bankruptcies into record territory.

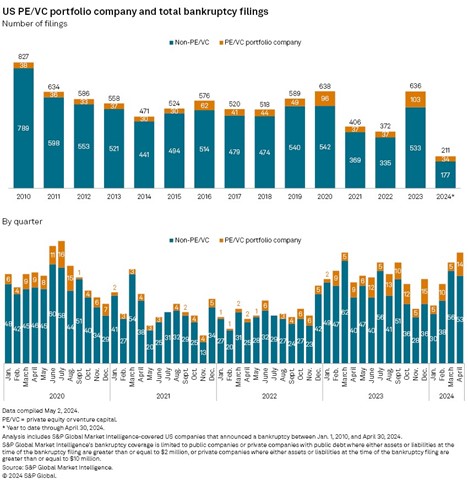

Bankruptcy filings by U.S. private equity portfolio companies reached an all-time high in 2023 and are on pace to nearly match that record in 2024, according to an S&P Global Market Intelligence analysis of bankruptcies filed between Jan. 1 and April 30. Private equity- and venture capital-backed companies also accounted for an unusually large portion of all bankruptcies recorded between Jan. 1 and April 30, at 16%. On average, the annual portion between 2010 and 2023 was under 9%.

Healthcare and consumer discretionary businesses bore the brunt of portfolio company bankruptcies in 2023, a trend continuing into early 2024.

The combination of sticky inflation and elevated interest rates was enough to put some portfolio companies on the ropes, especially those already reeling from COVID-era business disruptions, said Vincent Indelicato, co-head of the restructuring group at Proskauer Rose LLP.

“It not only has affected borrowing costs, which has created a barrier to refinancing [existing debt], it’s also presented headwinds for revenue generation for businesses that have exposure to consumers,” Indelicato said.

Michael Handler, a partner in King & Spalding LLP’s financial restructuring practice, adds that portfolio companies burdened by heavy debt from aggressive acquisitions have “less wiggle room for performance issues.” These companies are now being squeezed by rising costs and a slowdown in consumer spending. “There’s just so much debt in the system, and there are a lot of companies that have a lot of challenges,” Handler said, predicting portfolio company bankruptcies will remain elevated through 2024. Recent high-profile portfolio company filings include JOANN, Enviva, and ConvergeOne Holdings.

We’ve all heard the term ‘private equity,’ but the reality behind the term can be complex. Brendan Ballou, special counsel at the Department of Justice, summarizes: The basic business model of private equity is very straightforward. Private-equity firms take a little bit of their own money, some of investors’ money, and a whole lot of borrowed money to buy up companies. They then try to make financial or operational improvements and then flip the company, hopefully for a profit, a few years later.

Statistics show companies bought by private equity firms are far more likely to go bankrupt than companies that aren’t. According to researchers at California Polytechnic State University, roughly 20% of large companies acquired through leveraged buyouts go bankrupt within ten years, as compared to a control group’s bankruptcy rate of 2% during the same period.

How does private equity ownership affect a customer’s credit risk? Here’s a breakdown of the key risk items we see with private equity ownership:

- Crippling debt load: Many private equity acquisitions are financed with significant debt, which leads to unsustainable capital structures. The financial sponsors will typically load up the balance sheet with debt and pay themselves a dividend. They also tend to extract a lot of transaction and management fees from the acquired company.

- Insulated from consequences: Private equity firms are typically insulated from the consequences of their actions. When the portfolio firm does something illegal or wrong, the private-equity firm itself is rarely held liable. They also benefit from tax advantages that allow their executives to pay lower tax rates than the average individual. This combination of insulation and tax benefits creates a scenario where private equity firms reap disproportionate rewards when their strategies succeed while facing fewer consequences when things go away.

- Lack of transparency: Previously, you could easily access financial data to evaluate your customer’s risk. However, under private equity ownership, this crucial information might be difficult to obtain as they typically do not like to share key financial data. This lack of transparency makes it difficult to assess a customer’s creditworthiness.